Thursday 25 December 2014

Mises Institute, Library

23 Quotes from Warren Buffett on Life and Generosity

Saturday 20 December 2014

Top 10 Smart Beta ETFs in Europe

Tuesday 9 December 2014

Wednesday 26 November 2014

Your Equity Threshold And The Psychology Of Money

Interesting article on psychology and equity threshold.

Your Equity Threshold and the Psychology of Money - 2ndSkies Forex

Tuesday 25 November 2014

Friday 21 November 2014

How to lose everything after winning the prize of your life

However, what happens in practice is more often tragic. Here are some of those stories.

80% of Statistical Analysis is wrong

Thursday 20 November 2014

Rolesia - A macroeconomic simulation

If you want to be your own central banker, try this.

Rolesia - Virtual Economy Simulation 2014

Rolesia is a free, fun and strategic economy web simulation for all who enjoy strategy simulations, and for all wishing to discover and understand the policy tools on offer to Governments and Central Banks around the world. The purpose of the software is to help the world-wide population understand the complexity of the world economy, and also to understand the power behind governments’ fiscal and the central banks’ economic monetary policies. Helping to improve the world population’s knowledge is a small contribution towards empowering the people of this planet and strengthening democracy. The simulation can be perceived as an economy game based on a virtual economy.

Wednesday 19 November 2014

Can Money Buy You Happiness?

Can Money Buy Happiness? Here’s What Science Has to Say - WSJ

Can Money Buy You Happiness? It’s True to Some Extent. But Chances Are You’re not Getting the Most Bang for Your Buck.

Basic Investment Principles

Here is a list of very basic principles as prerequisite to investing. This is a concise list. Each line deserves a chapter, if not a book, on its own.

- Pay yourself first. Establish a habit to save regularly.

- Start early. Benefit from the magic of compounding interest.

- Keep costs low. Costs eat a huge portion of returns over time.

- Use value-averaging, or dollar-cost averaging. Invest regularly the same amounts at equal intervals. Because of markets' reversion to the mean this leads to dollar-cost-averaging of the asset price.

- Stick to index funds ("what you understand") as the core. Active funds are expensive and, in general, return less. Specialist funds or individual securities can be used as satellites. This is known as "core-satellite" strategy.

- Keep cash portion in liquid bonds for better returns.

- Stick to your asset allocation.

- Pay attention to the total return (income + growth). Income funds yield more but usually have lower total return. Tax effects of income - income is taxed immediately but tax on growth is delayed (taxed only if sold).

- Long-term price earnings (P/E) ratio is 14. Starting valuations matter.

- Asset allocation, the risk balance, is the main determinant of return. Bonds proportional to age (?).

The principles above come from various texts and personal experience. They should be refined over time.

Starting point valuations

A good article on valuations and starting point for investments by Shane Oliver.

Energy costs

These charts explain a lot:

Cost of electricity by source - Wikipedia, the free encyclopedia

Thursday 16 October 2014

Portfolio rebalancing a must for maximum gains

A good article on portfolio rebalancing:

Portfolio rebalancing a must for maximum gains - ASX

Three key strategies can help investors take advantage of portfolio rebalancing:

- Time-only. Triggers a rebalancing based on a set time schedule such as monthly, quarterly or annually.

- Threshold-only. Ignores time and triggers rebalancing only when a portfolio deviates from its target asset allocation by a predetermined minimum percentage, such as 1 per cent, 5 per cent, 10 per cent. It requires daily monitoring to determine timing.

- Time-and-Threshold. The portfolio is monitored on a set time schedule but is rebalanced only if the allocation deviates from the target by the predetermined minimum rebalancing threshold at that time.

Secret to great returns

Diversification, patience and buying when valuations are attractive, are key investment principles.

"Maximising the full range of investment opportunities, only purchasing when valuations are attractive and maintaining a well-diversified portfolio, are important investment principles."

Sub-points:

- Diversification is key

- Buying at the right price matters

- Be clear about your objectives and have a plan

- Consistently achieving a solid return

Tuesday 14 October 2014

More on Germany's budget and demographics

German model is ruinous for Germany, and deadly for Europe - Telegraph

The European Commission’s Ageing Report (2012) said Germany’s workforce will shrink by 200,000 a year this decade.

Friday 10 October 2014

CNN Money's Fear & Greed Index

Apart from being almost knocked into the red, the Fear & Greed Index is an interesting indicator to watch.

Fear & Greed Index - Investor Sentiment - CNNMoney

Saturday 27 September 2014

Odds of winning the jackpot in EuroMillions

1 in 116,531,800 chance, it seems, sounds just terrific for millions of those who play. If they actually knew the numbers they would probably stop playing at all.

EuroMillions Online Buy Lottery Tickets and Win

The Winning Odds Every draw there are 13 levels of winnings possible. For the lowest tier you have to correctly guess 2 of 5 drawn numbers. However, as there are balls with numbers up to 50 the odds of you winning it are 1 in 23. A chance to get right 2 main balls and one of the Lucky Stars is 1 in 46 whereas a chance to get right 1 main ball and both of the Lucky Stars is 1 in 157. The last tier with odds less than 1 in 1000 is 8th (3 +1 Lucky Star). The one higher up already reaches a 1 in 11,771 for 3+2. Certainly, you care about the big cash but how does a 1 in 116,531,800 chance sound? That’s how lucky you have to be to win the jackpot. But don’t worry, because an overall chance of winning anything in EuroMillions is 1 in 13 which is one of the best amongst the biggest lotteries’ in the business.

Friday 26 September 2014

An appropriate article on Dollar-Cost-Averaging

As the markets seem to entering a sell-off, an article on DCA might be appropriate:

Here's The Best Way To Buy Stocks If You Fear A Market Crash - Yahoo Finance

Wednesday 24 September 2014

Irrational exuberance down under

Monday 22 September 2014

Passive vs active investment, documentary

Friday 19 September 2014

Sunday 7 September 2014

Import Yahoo stock prices into Quicken

I use Yahoo! Finance portfolio as they have most of the securities from all over the world. Their portfolios feature is available to everyone and is quite fast and convenient. You can even create a separate view that includes only the symbol and price, which would perfectly match the export process.

Yahoo Finance - Business Finance, Stock Market, Quotes, News

To import prices into Quicken, do the following:

- Open your Yahoo portfolio

- Select and copy the table into clipboard (Ctrl+C)

- Open a Google spreadsheet

- Paste the table into an empty sheet

- Do some preparation here:

- Delete all columns except the security symbol and price if you are not using a custom view.

- Customize the symbols - remove extensions with Find/Replace, etc.

- Use "File -> Download as..." option to download a .csv file

- In Quicken, use File -> File Import -> Import security prices from .csv file

- In the pop-up dialog, select the date for the prices. I have not found the correct date format for the date so it is safer to simply select it in the dialog itself.

Note that the instructions refer to Quicken 2014 for Windows. The other software involved is pretty generic or online so should be available on all platforms.

Wednesday 27 August 2014

Tuesday 26 August 2014

35 Smart Things to Do With $1,000 Now | Money.com

'via Blog this'

Investment Reading

News:

- Bloomberg

- Wall Street Journal

Articles:

- Project Syndicate

- Seeking Alpha

- AMP News and Research, including Shane Oliver's Insights

Publications:

- Vanguard’s Principles for Investing Success (link)

- see recent publications from the Bank for International Settlements

Blogs:

- John Mauldin's Thoughts from the Frontline

- Mike Shedlock's TownHall

Friday 22 August 2014

Paul Piff: Does money make you mean? - YouTube

Paul Piff: Does money make you mean? - YouTube

7-Year-Old Entrepreneur - Business Insider

It's a good lesson on how to approach effort/work/ideas and the compensation received for it.

7-Year-Old Entrepreneur - Business Insider

Wednesday 20 August 2014

Market News Sources

Market news sources

- Reuters, Markets

- Marketwatch

- CNBC

- Yahoo! Finance

- Business Insider

- NetDania, and MNI Market News

- FT's Antenna

Analysis

- IB Traders' Insight

- IG Markets - Insight, Update

- NetDania

- Investing

Quotes

Indicators

Friday 15 August 2014

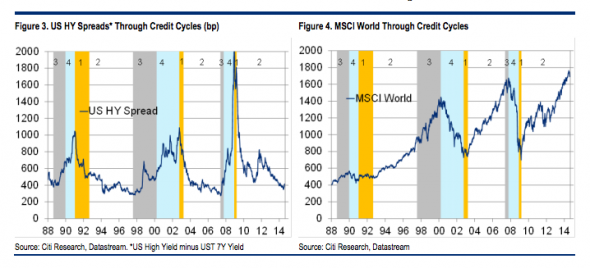

The leverage clock tolls for thee - Market Phases

and a historical view:

Source: The leverage clock tolls for thee | FT Alphaville

Tuesday 12 August 2014

Is the Australian model in trouble? | FT Alphaville

Is the Australian model in trouble? | FT Alphaville

Thursday 7 August 2014

Bogle's Legacy

What a coincidence to my current read of Bogle's Common Sense on Mutual Funds, passive investing is winning most of new investors' money.

http://www.marketwatch.com/story/bogles-legacy-returns-that-trounce-active-investing-2014-08-07?dist=afterbell

Wednesday 23 July 2014

Stock Charts: TradingView

EUSTX50: 3203 ▲+0.63% - TradingView

Tuesday 22 July 2014

Australian pay calculator

pay calculator

Monday 21 July 2014

Friday 18 July 2014

Wednesday 16 July 2014

Tuesday 15 July 2014

The Rich Are Even Richer - Bloomberg View

The Rich Are Even Richer - Bloomberg View

Monday 14 July 2014

Friday 11 July 2014

Free S&P ASX Index Total Return Accumulation Data

Free S&P ASX Index Total Return Accumulation Data http://feedproxy.google.com/~r/FusionInvesting/~3/jBQ64t1ZrRI/

Wednesday 9 July 2014

Stock market correction? Who cares?

Friday 4 July 2014

5 traps in using the dividend yield - Morningstar.com.au

5 traps in using the dividend yield - Morningstar.com.au

While dividends usually mark a profitable company, they are not the definitive marker of a good share. Using a low-cost broker and having shares that appreciate in value more than they pay in dividends could sometimes be a more efficient way to accumulate wealth.

Tuesday 1 July 2014

Renewables to Get Most of $7.7 Trillion Power Investments - Bloomberg

'via Blog this'

Monday 23 June 2014

Anglo-Saxon economies should envy Germany’s rental culture - FT.com

Anglo-Saxon economies should envy Germany’s rental culture - FT.com

Tuesday 17 June 2014

On-line Charts

On-line Charts :: Dukascopy Bank SA | Swiss Forex Bank | ECN Broker | Managed accounts | Swiss FX trading platform

Wednesday 11 June 2014

German demographic consequences

Monday 2 June 2014

BlackRock Cuts Europe ETF Fees

New funds are being introduced in Europe and the core line of funds already on offer will see their fees cut anywhere from 5 to 58 percent. More details on the Core series you can find here.

BlackRock Cuts Europe ETF Fees in Race With Vanguard for Assets - Bloomberg

Thursday 29 May 2014

Bogleheads Investing Advice and Info

There's a lot of content and advice available.

Bogleheads Investing Advice and Info

Wednesday 14 May 2014

Federal budget 2014

See the summary of all budget changes here: Federal budget 2014 | First State Super

Monday 12 May 2014

21 Quotes about investing

A few jewels from famous investors, collected by Shane Oliver:

http://www.businessinsider.com.au/shane-olivers-21-favourite-quotes-about-investing-2014-4

Quicken Tip: tracking performance after transferring shares

Source: Tracking Performance after transferring shares - Quicken Community

Thursday 1 May 2014

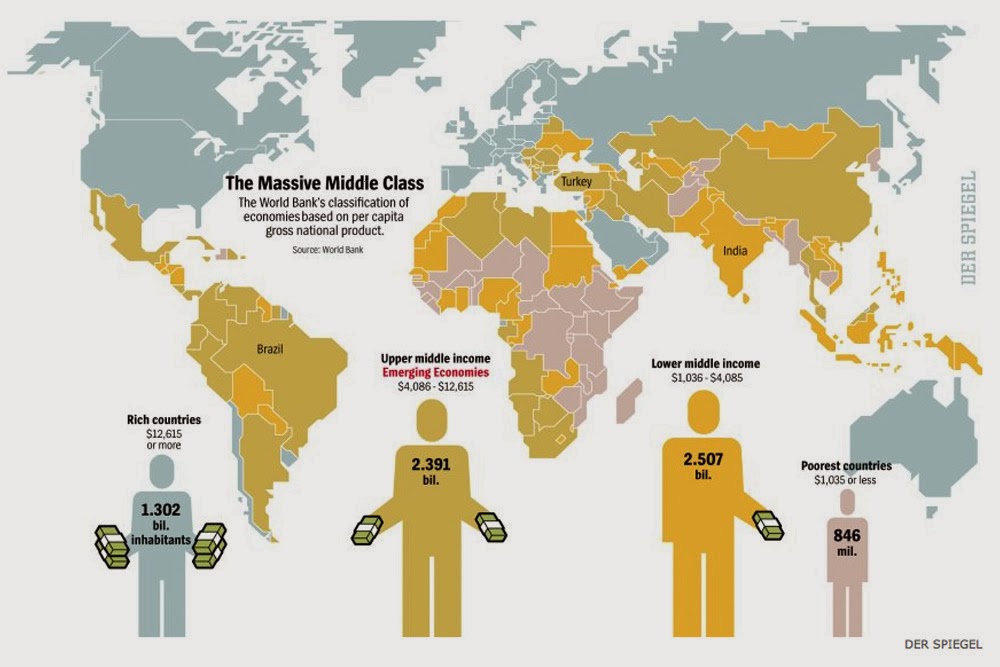

China to overtake US; Australia among the most expensive

http://www.ft.com/intl/cms/s/0/d79ffff8-cfb7-11e3-9b2b-00144feabdc0.html#axzz30V8cBV9X

" the report also found that the four most expensive countries to live in are Switzerland, Norway, Bermuda and Australia"

Monday 14 April 2014

BBC - Culture - The death of the US shopping mall

BBC - Culture - The death of the US shopping mall

Friday 11 April 2014

Thursday 10 April 2014

Credit Card Bin Checker

The retrieved information includes the card brand, issuing institution, card type, level, country and so on.

Friday 28 March 2014

Wednesday 12 March 2014

Fixed income when rates rise

Raising rates have a devastating effect on fixed income securities, mostly bonds. This concerns conservative investors and retirees who rely on bonds to deliver a reliable income stream.

Below are some materials that shed more light onto the topic.

- When rates rise - What happens to fixed-income ETFs (link) - iShares

- Raising Rates: A case for active bond investing? (link) - Vanguard

- Risk of loss: Should the prospect of rising rates push investors from high-quality bonds? (link) - Vanguard

- Why invest in bonds when interest rates can only go up? (link) - Vanguard

- The role of fixed income as part of a diversified investment strategy (link) - Vanguard

Monday 24 February 2014

Australia vs Austria in World Country Facts

Australia vs Austria in World Country Facts

What puzzled me the most is that the GDP figures are really close, within 5% of each other. Australia is just a tad higher. However, unemployment in Austria is lower and the current account balance is positive. Not sure how old is the data though.

From the quality of life perspective, there are 14% of Australians working long hours vs ~9% of Austrians.

Another important factor is the GINI Coefficient, which measures the degree of inequality of income.

Thursday 13 February 2014

Monday 10 February 2014

A behavioural barrier to successful saving

Tuesday 4 February 2014

6 lessons from The Wolf of Wall Street - Morningstar

6 lessons from The Wolf of Wall Street - Morningstar.com.au

Sunday 26 January 2014

IG Trading - Android Apps on Google Play

IG Trading - Android Apps on Google Play

It is one of the tools that can give a quick overview of the world markets with charts.

Die App zur Guthabenkontrolle - PayLife Quick

Die App zur Guthabenkontrolle - PayLife Quick

Monday 20 January 2014

Vanguard's economic and investment outlook

Saturday 4 January 2014

The one-page guide to financial independence

A view on how to reach financial independence.

"The one-page guide to financial independence" http://feedly.com/k/KmFfvl

Review of 2013

8 Million Acres of China's Farmland is Too Polluted to Farm; All Farm Products From China Suspect

"8 Million Acres of China's Farmland is Too Polluted to Farm; All Farm Products From China Suspect; Iceberg Principle" http://feedly.com/k/1lFRZbu