Saturday 29 November 2008

Friday 28 November 2008

ASX S&P 200 closing onto 3700

November started with a presidential rally and is closing with a rally.

ASX 200 is hitting 3700 from below at the moment.

Has recovery started?

So, either a new suckers' rally or the beginning of phase 1? I'm an optimist so I'll go with option #2. Hope this is the phase 1 entering.

Thursday 27 November 2008

Serbia may emerge stronger out of the crisis

According to WorldBank's country manager, Serbia may emerge stronger once the economic crisis ends.

These are good signs for the region's future.

Volcker back in the game

Paul Volcker has been named the head of the President's Economic Recovery Advisory Board. The board is to provide independent economic advice to the new President. Many had hoped that Volcker would come back to the scene in time of crisis as he was the Fed chairman from 1979 to 1987.

This news propped the markets further upwards. The ASX is to open higher. Australian S&P 200 reached almost 3700 overnight. It is to open at 3540, where it closed yesterday. All Ordinaries are about 50 points lower.

Wednesday 26 November 2008

A different view to a solution to the current crisis in the US

This interesting article lists possible steps needed to start fixing the mess in the US financial system. What strikes me is that, if implemented, the US financial system would pretty much resemble the European one.

Tuesday 25 November 2008

Australia to be hit only next year

BNP Paribas sees Australia at zero growth in 2009, with Australian Dollar hitting 47 US cents. Those would be followed by 2.75 percent cash rate.

First Glimpses of Recovery

OK, so this is what it's like when the good news start appearing. After the first positive signs coming from China, this comment from Gottliebsen adds an icing on the cake.

There might be the first signs of a sustainable recovery.

Another fact is that, the lower the market indexes are the stronger the buying pressure gets.

The ASX S&P200, led by gains in Wall Street, hovers around 3600 after bouncing off 3200 level, reached last week.

China Recovering

The effects of the Chinese Government stimulus released earlier are beginning to appear. If sustainable, this would be extremely good news for the Australian economy.

Market as a Discounting Mechanism

Markets are efficient in a sense that all the known news and forecasts are already calculated in the market price.

It has already been said that markets are moved by sentiment and tremendously affected by expectations. Noone can say with absolute certainty if or when there is going to be a ground-breaking event in the future, like new war or a sudden increase in demand of any commodity, service, or currency. But all the known facts (and distortions) are calculated into the current market price.

So, markets may not further when there is only doom and gloom in the news. All the foreseen doom and gloom is already there - in the market price. So, as things go for worse or are expected to go for worse, the market price will fall. Likewise, as things improve or are expected to improve, the market price will rise.

The above article also mentions that Nouriel Roubini also thinks the recession would end before the end of 2009.

My thoughts is that the market has to stabilize for some time (Stage 1 as shown here), before it can start another growth stage (Stage 2).

Stages in the Economic Cycle

The chart shows stages in the economic cycle. Markets move in a similar manner all the time. Hence, the four stages can be identified:

- Establishing a base

- Growth

- Top stage

- Decline

Monday 24 November 2008

National Rental Affordability Scheme

A new scheme has been adopted to offer affordable rentals for low and middle income earners. The Government will subsidize the rent for those income groups who rent their accommodation. This should reduce the pressure on the rent prices and push the home building a bit.

Rescue Package for CitiBank

Losses to be shared by Fed, Federal Deposit Insurance Corporation, and Treasury.

Home Building Recovery in 2009

Housing may resume growth in 2009, in Australia.

Friday 21 November 2008

Geithner - the New Treasury Secretary Nomination?

Timothy Geithner, the president of the New York Federal Reserve Bank, is expected to be tapped by President-elect Barack Obama to be the next secretary of the US Treasury, NBC News and the Wall Street Journal have reported.This news propped up the markets yesterday.

US Housing May Bottom Next Year

The troubled US housing market should find a bottom in the middle of 2009, Philadelphia Federal Reserve President Charles Plosser has said, but he acknowledged the outlook remains highly uncertain.

US Economy to Rebound in 2009

"Many analysts expect the US economy to regain

positive momentum sometime in 2009," Richmond Fed Bank President

Jeffrey Lacker said in a speech to the Tech Council of Maryland.

Mr Lacker argued the economy could be seen as ready to rebound next year.

Monetary policy is "quite stimulative," he said. Also, the major shocks that have dampened economic activity this year "have subsided already or are in the process of doing so," he added.

First signs of easing?

House sales in some parts of the US, like Orange County, are increasing. The prices are low but the fall has eased a bit in the recent months.

Housing affordability also increased in New Zealand.

Thursday 20 November 2008

From Financial Crisis to Cyclical Recession

As Stratfor writes, the current financial crisis has been mitigated, if not solved. The problem now is that we are entering a cyclical recession. The economies worldwide now have to find their way out of it. More discipline has to be established in the economies running wild.

There is also a social component to the problem. Fixing economy will not necessarily be the top priority of the governments around the world. Wellbeing of their citizens and the political stability, more probably, will.

The recession is now triggering a range of bankruptcies and it is a matter of which companies live and which do not.

Current Sell-Off

Current sell-off in the US is caused by margin clauses, an increase in anticipated LBO defaults, and hedge fund clients' withdrawal, according to Fitch.

Entering Phase Two

The markets are entering the phase two of the crisis – recession and deflation – and the phase one – the unravelling of the financial sector – is still underway. No good news around at all these days.

The Australian S&P 200 is at 3200. That is more than 50% down from a year ago.

Wednesday 19 November 2008

Serbia Reached a Deal with IMF on a $516 Million Loan

As reported by RGE,

- Serbia secured a $516mn standby loan from the IMF, the fourth Eastern European nation (after Hungary, Ukraine and Belarus) to tap the institution for funds, to help stabilize the economy during the global financial crisis. The govt. said it would not necessarily draw any funds from the loan but wants to restore investor confidence in Serbia

- Global financial turmoil has made investors risk averse, resulting in a continued currency decline and sharp fall in the main stock indices. Since the beginning of October, Serbian central bank (NBS) has used €472mn ($601mn) to slow the slide of dinar, which has weakened 20% against the dollar during August-November. Official hard currency reserves fell to $12bn in October from $14bn in September

Deflation

Both Consumer Price Index (CPI) and Producer Price Index (PPI) have been falling in the US for the past three months. This is a very rare event. It happened only five times since 1947.

Tuesday 18 November 2008

Petrol Almost at Historic Lows

Mark J. Perry, in an article at Seeking Alpha, states that the real price of petrol is nearing its historic lows. As can be seen in the following graph, the inflation-adjusted price of petrol is almost lowest it has ever been. Absurdly, this kind of energy is now cheaper than ever while only a couple of months ago it was the most expensive ever.

The good consequence is that this will help lift the economy when the time comes.

ASX 200 at 3520

The ASX S&P 200 index has closed today at the level of 3523.2. This is the level last seen in 2004. The volume has reduced in the past few days. There are not that many interested buyers, it seems.

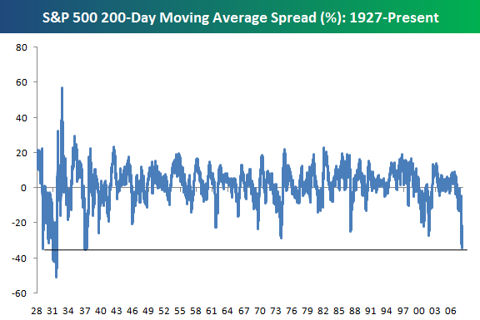

US S&P 500 200-Day Moving Average Spread

The current level for the US S&P 500 is 32% below its 200-day moving average. This is the lowest level since the Great Depression. The good thing is that a bounce from such low usually shoots high on the positive side.

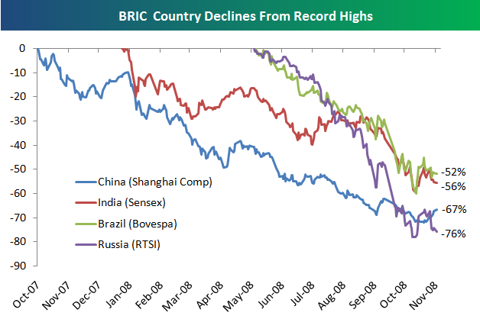

BRIC Countries’ Position

The article at Seeking Alpha shows the index positions of the BRIC countries (Brazil, Russia, India, and China). As can be seen, they are deep down from last year’s levels.

US Consumer Confidence Steady in November

Consumer confidence fell only 2.3 points in November after the October collapse.

These are positive signs. Apart from financials and car makers, not many industries are screaming for help. We could be in the eye of the storm.

Valuations for companies is getting attractive.

US Halfway through Recession

Business Spectator - SCOREBOARD: Halfway day

This survey, released last night, suggested that the US economy was already in recession in April, with a duration of 14 months forecast – I guess the positive spin on that is that we are already halfway.

Monday 17 November 2008

Layoffs

There is a web site that tracks layoffs in the tech sector during the current economic downturn. It is interesting (and scary) to follow through, since tech companies are now affected by wave of layoffs worldwide. The main effort being to save cash during uncertain times.

October 2008 was particularly hard in this sector. Well, not unlike other sectors.

Iceland on the way to IMF deal

Iceland has reached an agreement with foreign savers to repay deposits in their collapsed banks. This is a step closer to realizing the deal with IMF that would help the country recovery.

It seems that the sentiment is changing in regards to their joining the EU in the future to prevent similar collapses.

Baltic Dry Index Making a U Turn?

Baltic Dry Index, as mentioned the other day in a recent post, is not only holding on to the current levels but actually moving up.

This is interesting development since the stock market is continuing moving downwards.

G20

It appears that the G20 meeting accomplished nothing. The results were as expected earlier. And they were already watered down prior to the meeting so that no major moves were even expected.

The next meeting is in April. Until then, everyone seems to be waiting for the new President of the US to get into position and see whether the agreed policies will be implemented and how.

All this is showing in the market which, in the case of ASX 200 index, is dragging around 3640 at the moment, which is the the lowest point so far.

Sunday 16 November 2008

Iceland: From World's #2 to a Ruin in Less than a Year

There is an interesting article about Iceland at Financial Times web site. It portrays the effects of a real financial meltdown.

Having lived in the Balkans area, the image portrayed by the article is not as bad as some I saw earlier. Still, what must be terrifying is that the change from the top (Iceland was world's number two country judged by the quality of life just last year) to the bottom (Iceland, as a country, is at the brink of a bankruptcy right now) happened in less than a year. Makes me wonder if this is the sign of the times. The distinction between developed and developing countries is diminishing.

For example, comparing economic situation in Bosnia and Iceland, I'd probably choose Bosnia as it seems relatively unaffected by the global turmoil. And credit cards issued there definitely are accepted worldwide, which is not the case with Iceland's at the moment. Seems too weird to be true on the first glance. We'll have to get used to it.

Friday 14 November 2008

A look at the future

An article from RGE site, written by Fabius Maximus, shows how the current crisis is different than others and is, therefore, harder to foresee the future. It contains a long list of links to other articles, written by the RGE team, that forecast certain aspects of geopolitical and economic system we will live in. A good read.

As always, take with a grain of salt. Noone knows what is about to happen and that is the best thing of all - uncertainty.

Property First to Show Signs of Recovery

A RaboPlus article on property presents an opinion that real estate is the first to suffer in an economic downturn but also the first to show the signs of recovery.

Property funds in Australia have kept their levels above the recently hit lows and, statistically, have recovered around 20% since then. Whether that means that the worst is over or not, remains to be seen. It is possible that there will be more to downturn in the near future.

Baltic Dry Index Flat

According to the action of the past few days where markets fell down while Baltic Dry Index remained at the same level, some conclude it might be another sign of the bottom.

And a short-term chart:

Congressional Hearing on Hedge Funds

There is a Congressional hearing going on in the US about the role of hedge funds in the current crisis. Possible outcome of this will be a regulation of the sector and more transparency of the shadow banking system, which is unravelling right now.

Thursday 13 November 2008

Financial Markets Easing

All the efforts by the central banks are having an effect and lending should be heading towards more or less normal conditions. The Fed's move in buying preferential shares in financial institutions should also work in that direction.

On the other hand, in the real economy, the conditions are deteriorating fast. The unemployment is on the rise, but nothing spectacular yet. Consumer sentiment is falling, as well as investors'. Fortunately, the surprise on the upside, one day, should be the same as on the downside. If analysts could have foreseen this crisis, it would have never been here.

Australia to Outlaw Naked Short Selling

Average Weekly Wage in Australia $1,147

Average annual wage in Australia is now very close to $60,000. Multiplying the above amount by 52 weeks makes $59,644.

Petrol Prices at $1.20

Petrol prices are currently at A$1.20 and expected to go lower.

Wednesday 12 November 2008

The Worst Economy Since…

Let's Clarify "The Worst Economy Since...." Debate - Seeking Alpha

The graph above puts all the talk about “the worst economy since …” into perspective. The current unemployment in the US is at 6.5% and the consensus is that it will go to 6.8% next year. Even at 7% it is only slightly comparable to some previous crises.

Fed Actions

Business Spectator - US Fed may step in to soothe markets

When financial markets stabilise and economies start to recover, central banks will need to decide how to phase out extraordinary provisions of liquidity and other credit-market interventions, he said.I find it a good sign that high officials are mentioning the time when all this will be over and the time to clean up the mess. As stated above, some provisions will become permanent part of the financial world.

In the meantime, some tools created to combat the crisis may become a permanent part of central bank instruments, Mr Kohn said.

Yesterday, Paulson gave up on purchasing toxic mortgages so it will be interesting what happens with the markets until the end of the week. Then, another big event - the G20 meeting, starting tomorrow.

The next couple of days are interesting because the Australian index should either confirm the resistance or break through it.

![moz-screenshot-6[4] moz-screenshot-6[4]](http://lh5.ggpht.com/_OQmvB1RsiBI/SRtWhgcvqmI/AAAAAAAAAvI/ImyGe_1FTrg/moz-screenshot-6%5B4%5D_thumb.jpg?imgmax=800)

Tuesday 11 November 2008

No Recession in Australia?

Moody's Economy.com is forecasting the Australian economy to record positive growth in the first and second quarters of 2009, for a calendar year result of a little more than one per cent.Both the government institutions and private analysts forecast that Australia's economy will grow next year. Albeit, a little bit above 1% but that is still better than many other developed countries.

Monday 10 November 2008

Withholding Tax for Non-Residents

Non-residents for taxation purposes in Australia pay withholding tax on income earned from Australian sources. The link above contains the rates at which different passive income is taxed. Interest is taxed at 10% and unfranked dividends are taxed at 30%. Franked dividends are not taxed.

The tax is automatically withheld by the issuing institution and there is no need to submit a tax return or to pay the tax separately.

Bullishness on the Rise

It seems that investors are getting nervous and getting back into the market. The OIS (similar to VIX indicator but less prone to manipulation) is at 0.5%. This is the interbank lending rate, which is now well into normal territory.

The sentiment, in general, is improving. The crisis has well affected the real world. The companies reduce their earning estimates, the unemployment is on the rise. Hopefully, drop in stock prices is higher than the drop in earnings will be. This should be good for the buyers of dividend stocks.

The estimates in Australia are that the Australian Dollar should bounce back sometimes in mid-2009. That would mean that the commodities demand would increase in the next several months, driving the prices up and along them the Dollar.

Some estimate we are now within 20% of the possible bottom. Well, in ASX terms this could well translate into 3600, reached two weeks ago.

Today the index is moving upwards. This week there is the G20 meeting in Washington and the new US president is to name the top economic roles in the new government.

Saturday 8 November 2008

Financial Reforms in the Making

The financial markets reform agenda is developing in the US and Europe. It is inevitable, given the nature of the problems that have occurred, that we are going to have a significant reform agendaWhether something significant happens at the G20 meeting next week or not, the financial world will soon change. Reforms in the regulation are already in the making and will become public soon.

Prospects for the Eastern Europe

The east European countries would be making a grave mistake in assuming that the present global economic financial market crisis is but a passing phenomenon.According to this view there are hard times ahead for the Eastern Europe. And it will not last for a short time only.

Friday 7 November 2008

Markets Today

"There is a growing sentiment that we have seen the lows for some time and now people want to get in,"Markets continued choppy way up today. The sentence above best describes the current atmosphere. A lot of bad news has been priced in and unless something happen out of nowhere, the way for the market is sideways or slow upwards.

Wednesday 5 November 2008

Markets Up as Expected

As forecasted, the markets continue on the way up. It’s the US elections that are providing some stability at the moment.

The ASX 200 is around 4340 during closing time. The comeback is fierce on a long-term scale. It is approaching the 210 moving average line.

A very few analysts are providing more insight into this rally. Most appear to agree there will be more turmoil ahead. But, what is a stock market without turmoil?

Anyway, it is nice to see it coming back up.

Citibank Investing in Serbia

Sad to hear that the wars in ex-Yugoslavia prevented Citibank from establishing their Central and Eastern Europe office in Belgrade in 1990. They are coming back to this market next year.

I wonder if it would be painless to open a Citibank account in Australia and then use it to have an easier way to send the funds to the other side of the world.

Tuesday 4 November 2008

Economic Situation in South-Eastern Europe

There are excellent analysis of the economic trends and situation in the South-Eastern Europe.

Monday 3 November 2008

RaboPlus Waives Fund Fees

Right on time to do some purchasing. :D

Current Economic Conditions in Australia

The article contains a review of current economic indicators for Australia. Inflation is sliding lower quickly. The number of job ads fell 5.9% in October, house prices fell 1.8% in the third quarter, and interest rates are all falling down. Retail sales sank 1.1% in September.

The market already priced in the new RBA rate cut, which will be decided tomorrow.

Investing in a Bear Market

The sum of the previous analysis suggests that we can discount a 1930's style wipeout of the stock market, and viewing a volatile sideways trend for at least the next 6 months to be followed by an gradual upward curve.An analysis of the situation at FTSE stock market. Done even before the last week's lows. Forecasting slow upwards movement from there.

Glad that I came to the same conclusions. Buy at dips and in installments as the market is so volatile. The only reasonable thing is to average the whole low period instead of gambling on the bottom in one go. I've "had" so many bottoms in the past couple of months. Fortunately, I invested only small amounts and generally averaged down the initial investments. And, yes, just like Buffett, I'm more interested in steady flow of dividends than the stellar jumps of growth stocks.

Here is the most important part of the article, listing step-by-step instructions on how to invest in a bear market:

An investment strategy needs to take these factors into account to determine when the anticipated capital is to be invested.

- Bear Markets Analysis - Favors buying on selloff's during the post 30% drop bear phase.

- LIBOR is frozen so is a negative for investing at this time. The aim is to see LIBOR to fall to below 0.7% above base the interest rate. Current is 1.16%, the more it falls the more bullish the outlook for the stock markets.

- Chart price patterns remain negative, they clearly indicate that the stock market is not done on the downside.

Therefore the rules for stock market investing are -

1. Allocate the amount of capital that is to be invested over a period of time as 100%.

2. The aim is to invest between 5% and 15% per month of the above capital.

3. The trigger for 10% investment in any month is if the stock indices one is investing are within 10% from the bear markets low.

4. The Trigger for an additional 5% investment is if in any month LIBOR is below 0.7% above the base interest rate.

The goal is to scale into the stock market over the next 6 to 12 months i.e. effectively buying into weakness rather than strength and limiting investing when the market exhibits a sharp rally. This implies an investment range of between 5% and 15% in any given month.

I.e. if the intention is to invest $10,000 into the stock market then one would aim to invest between $500 to $1,500 in any month that fullfilled the investment criteria.

Therefore depending on how the stock market performs over the next 12 months, the amount invested in a stocks portfolio should gradually increase towards the 100% commitment.

It's a Trader's Market - Forecast for the Rest of 2008 and Beyond

On average traders can expect market gains for the remainder of 2008; doesn't that sound nice? Specifically, we can expect a 10-15 percent gain between now and year's end, based on the quarterly analysis. Additionally, based on the top ten monthly losses we can expect marginal losses in November and solid gains in December and January (3 months later). By aggregating the information, the case for the bulls is even more powerful, but the bearish case is NOT closed. It is almost certain that volatility will continue to be front and center, which will foster an environment fit for traders.I don't know if it's me picking the bullish signs or is it that more and more analysts are throwing these out into public. Apparently, from now until the end of the year there is 10-15% gain to be made. Adding to the gain made last week, that should be the bulk of recovery from the bottom last month. After that it's a phase 1 - sideways movement for some time until another bull starts.

That's what the books say. Now, to invest or not, the choice is yours.

More Bulls Raise Their Voice

Tighter regulation is coming and we’ll face a relatively long, deep recession until Q4’09. But by Leuthold's calculation, stock market bottoms occur when a recession is 60% over. That’s this month.There are more bullish signs in the news. We can see that there is some buying in the markets as prices go up steadily.

The credit markets are easing and credit is flowing again. After the US elections there should be more stability, as well.

So, according to the quote above, the recession is to go on through the 2009 but the market bottom has been reached last week. Or is very close to it.

Inflation Starts Decreasing in Australia

It is expected that inflation will continue to slide and reach RBA target of 2-3% mid 2009, well ahead of expected 2010.

Rents are also decreasing by a small percentage but will hopefully continue the trend.

Sunday 2 November 2008

Reversal at the End of October

Whether these reversals are the real thing or just a prop at the end of the month that the funds needed remains to be seen next week...

Saturday 1 November 2008

Credit is Flowing Again

These figures have helped most of the this week's rally in the share market prices.

Still, where to from here nobody seems to know.